To better understand Bill McBride’s perspective on the current housing and economic cycle, ResiClub reached out and conducted a Q&A with him.

Years before the housing bubble burst in 2008, housing analyst Bill McBride began chronicling the troubles in the U.S. housing market in his blog Calculated Risk.

Not only did he predict the crash, but he also called the 2012 housing price bottom. Fast-forward to 2024, and this cycle he hasn’t been as concerned as he was in 2007.

McBride has maintained for the past few years that this housing cycle will ultimately resemble something closer to the 1978 to 1982 period—a time of overheated house price growth that saw spiked interest rates, strained affordability, crashed existing home sales volume, and yet no national home price crash—rather than the 2007-2011 national housing price crash years.

To better understand Bill McBride’s perspective on the current housing and economic cycle, ResiClub reached out and conducted a Q&A with him.

Q: Historically speaking, the economy usually sees a rollover in residential construction employment prior to the onset of the recession. So far, residential construction employment has stayed near cycle highs. Is that a signal for a soft landing? Or could the rollover simply be delayed by the huge pipeline of multifamily units?

New home sales and housing starts are excellent leading indicators for the economy. However, with existing home sales depressed due to a combination of limited existing home inventory and stretched affordability, new home sales and single-family housing starts have performed fairly well. This is because the homebuilders have been able to offer incentives, such has buying down mortgage rates, to boost sales. The current residential construction weakness – as you noted – is in the multi-family sector, and this isn’t as reliable a leading indicator for the economy as the single-family sector. It seems likely we will see construction employment decline later this year or in 2025 as multi-family units are completed. And there is also weakness in some commercial real estate sectors, especially the office and retail sectors. However, these sectors do not employ as many workers as the single-family residential sector, and it seems unlikely this will lead to a recession in the near term.

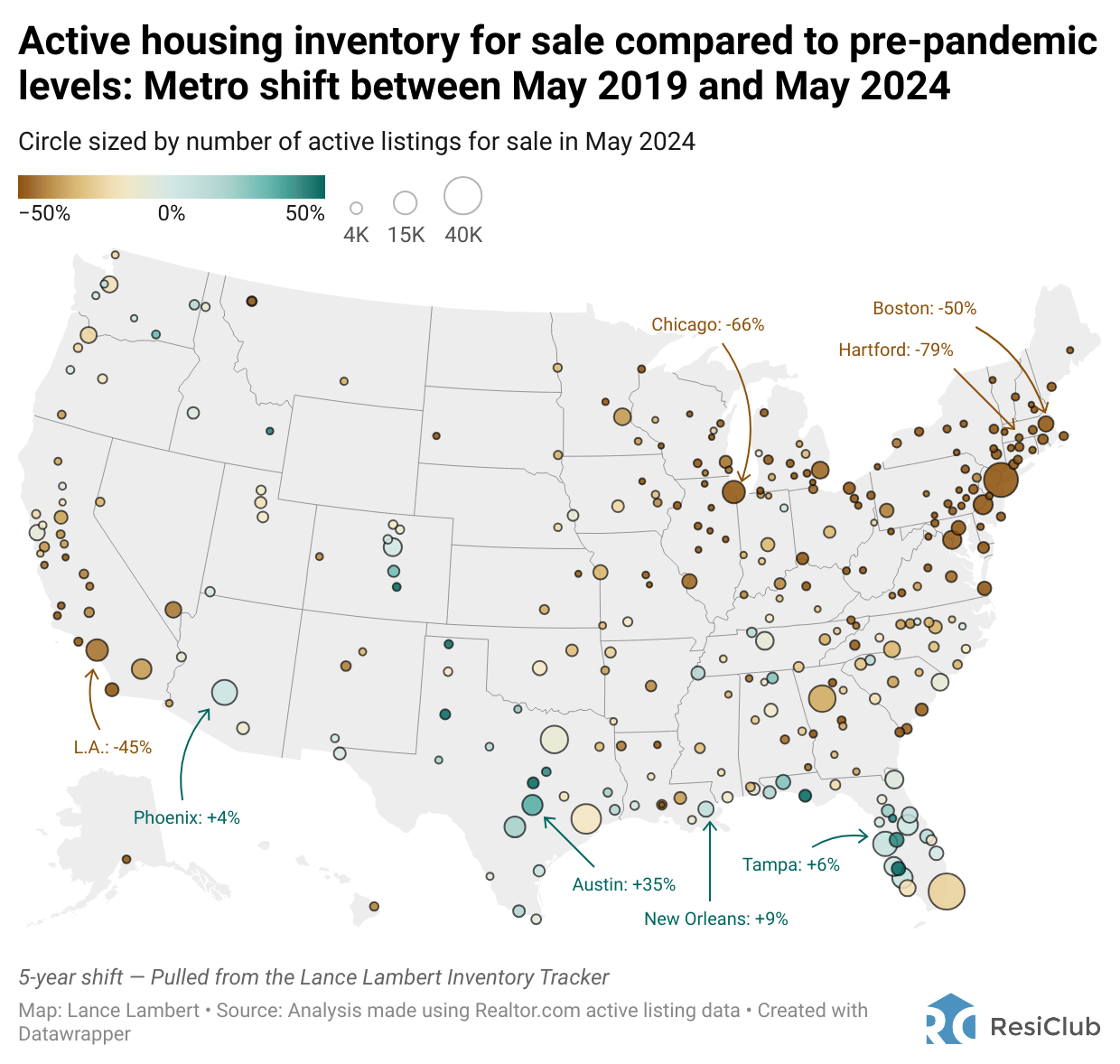

Q: While national active inventory for sale is rising on a year-over-year basis, national home prices continue to inch higher. Is there a certain level of inventory or months of supply in which you think we’d start to see national home prices fall again or soften?

The rule of thumb has been that house prices decline with more than 6 months of inventory. However, in 2022, we saw national price declines (as measured by Case-Shiller) with months-of-supply in the 3s! This was probably because inventory increased sharply in 2022, and some potential sellers were remembering what happened during the housing bust with cascading price declines. Months-of-supply as reported by the National Association of Realtors (NAR) has been rising steadily, and the NAR reported months-of-supply was 3.7 in May [the chart below shows 3.6 because it’s using a different series]. I expect this measure to continue to increase, and be over 4 months soon – and to be above 2019 levels in a few months. This doesn’t mean national price declines, but it suggests price growth will slow significantly later this year. We might see national price decline with months-of-supply above 5 (as opposed to 6) since most potential sellers have substantial equity and might be willing to sell for a little less. I’m tracking this very closely, for example see: Watch Months-of-Supply!

Q: What is causing the sharp increase in inventory in the South, especially in Florida and Texas?

Inventory is up sharply, and already above 2019 levels in many parts of Florida. I think the primary reason is the lack of affordable homeowners’ insurance because of destructive storms and rising sea levels due to climate change. A year ago I wrote: The Long-Term Housing and Population Shift. I noted that a combination of water availability and widespread use of AC drove the growth in the West and South over the last 60 years. However, climate change might make some areas further north more desirable. I think we are starting to see the start of that trend!

Q: You rightly called the housing crash before it started in 2006. When did you start to realize something bad was brewing?

In 2004, I was talking with a young woman at my gym, and she told me she just bought a $400K condo with no money down. I knew how much she made, about $40K per year, and the numbers seemed crazy. She told me she had a 1% teaser rate for the first two years. What happens after that I asked? She said she’d either refinance or sell the condo for a profit. That conversation started me on a journey of discovery. I started the Calculated Risk blog in January 2005 to share my thoughts with a few friends and colleagues. The key question was: Why are lenders making loans that would likely default? My friend and mortgage expert, Doris “Tanta” Dungey (see Doris Dungey, Prescient Finance Blogger, Dies at 47) joined the blog helped answer that question. And I was able to predict that house prices would fall sharply in many areas, exacerbated by a flood of distressed sales, and that this would lead to a recession – and possibly a financial crisis. In 2005, I argued inventory would tell the tale, and when inventory started increasing sharply in the 2nd half of 2005, I called the top for house prices. I’m still watching inventory closely (although there will be few distressed sales this time). Some people thought I was crazy when I argued house prices would fall 40%+ in some areas, but that is what happened. I also called the bottom for the economy in early 2009 (Looking for the Sun), and for house prices in 2012 (The Bottom is Here). Many of my readers thought I was a permabear, and were surprised when I turned optimistic!

Q: What do you think is the biggest long-term headwind facing the U.S. housing market? And what do you think is the biggest long-term tailwind facing the U.S. housing market?

Probably the biggest headwind is restrictive policies that limit construction in many desirable areas. For California, this is a severe problem. Other headwinds include the lack of water in the Southwest, and the impact of climate change, especially in some of the southern states. Perhaps the biggest tailwind, at least compared to other first world countries, is favorable demographics. Also, as climate change slows growth in certain states, it will likely be a positive for states with plenty of water and buildable land.