You built something extraordinary. You created wealth that can span generations. You've earned the right to protect it, grow it, and pass it on with intention.

But here's the hard truth nobody wants to say out loud: most family offices are sitting on ticking time bombs disguised as "informal processes" and "family culture."

The mistakes you're making right now: the ones you can't see because they're hidden in trust and tradition: are quietly eroding the very legacy you're trying to preserve.

I've sat across the table from brilliant families managing $50 million, $100 million, even $500 million in assets. Smart people. Accomplished operators. Exceptional wealth creators.

And I've watched the same seven governance mistakes sabotage their success over and over again.

The good news? Every single one of these mistakes is fixable. Not with complex restructuring. Not with expensive consultants on retainer for years. But with clarity, courage, and a willingness to make the implicit explicit.

Let's get to work.

MISTAKE #1: Lack of Clarity in Roles and Responsibilities

Here's what happens when roles are fuzzy:

Your nephew thinks he's running investments. Your daughter believes she's in charge of strategy. Your Chief Investment Officer assumes he has final authority. And nobody knows who actually decides anything until there's a problem: at which point everyone's offended, confused, or checked out.

The cost? Slow decisions. Internal conflict. Wasted energy. Low morale. Opportunities lost while everyone waits for someone else to lead.

The Fix: Build a Governance Charter (Even a Two-Page Version)

You don't need a 40-page document. You need clarity:

- Job descriptions for every role (including family members)

- RACI matrices (who's Responsible, Accountable, Consulted, Informed for major decisions)

- An organizational chart that reflects reality, not nostalgia

Pro move: Implement role rotation or job shadowing to expose grey zones before they become conflict zones. Tie responsibilities to performance reviews. Make clarity non-negotiable.

When everyone knows their lane, the whole operation accelerates.

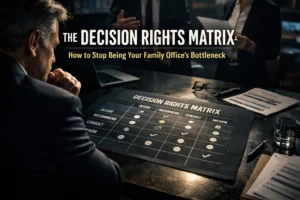

MISTAKE #2: No Formal Decision-Making Framework

You're running a family office like it's still 1987. Decisions happen over dinner. Agreements are made with a handshake. Someone's nephew gets hired because "he needs direction."

The result? Inconsistent decisions. Bias masquerading as intuition. Delays that cost you deals. Family disputes that simmer for years.

The Fix: Document Who Decides What (And How)

Create a decision-making framework that answers:

- Who approves investments over $X?

- Who has authority on operating decisions vs strategic pivots?

- What's the escalation path when people disagree?

- How do you resolve conflicts without nuking Thanksgiving dinner?

Keep a decision register: a living log of key decisions, rationale, and outcomes. Review it quarterly. When someone asks "Why did we do that?" you have an answer that isn't "Uncle Joe felt strongly about it."

This is not bureaucracy. This is horsepower.

MISTAKE #3: Ineffective Communication and Alignment

Family offices die in the gaps. The space between "We all know what we're doing" and "Wait, I thought you were handling that."

When communication is irregular, informal, and inconsistent, trust erodes. Family members disengage. Resources get wasted. Relationships fracture.

The Fix: Structure Your Communication Like You Mean It

Implement:

- Quarterly family assemblies (not "whenever we feel like it")

- Transparent reporting dashboards everyone can access

- A digital hub for governance documents, meeting notes, and decisions

- Feedback surveys to catch misalignment before it metastasizes

Bonus: Create a family vision statement and integrate it into onboarding for every family member, employee, and advisor. Alignment starts with shared language.

Stop assuming everyone's on the same page. Build the page. Share the page. Update the page.

MISTAKE #4: Poor Conflict Management (Or Just Ignoring It)

Family conflict doesn't go away because you pretend it doesn't exist. It compounds. It festers. It shows up in passive-aggressive emails, silent treatment at board meetings, and surprise veto votes that derail deals.

Unresolved disputes jeopardize relationships AND wealth preservation.

The Fix: Build Conflict Protocols Into Your Family Charter

Your family charter should include:

- Mediation processes (neutral third parties, agreed-upon facilitators)

- Structured meeting formats for hard conversations

- Clear triggers for when informal resolution has failed and formal intervention begins

Think of conflict management as preventative maintenance. You're not planning for war. You're planning to preserve trust under pressure.

The families that thrive long-term? They don't avoid conflict. They manage it with grace and structure.

MISTAKE #5: Insufficient Transparency and Trust

When decisions are made behind closed doors and only a few insiders know what's really happening, you create a two-tier system: those in the know, and those left out.

The ones left out? They don't trust you. They don't engage. They quietly resent the process. And when succession or liquidity events arrive, that resentment becomes resistance.

The Fix: Open the Loop

You don't need to share every detail with every person. But you do need consistent, inclusive communication:

- Regular updates on portfolio performance

- Transparency about major decisions (even the ones that didn't work out)

- Open forums where stakeholders can ask questions and be heard

When people feel informed, respected, and included, they become allies instead of obstacles.

Trust isn't built with words. It's built with repeated transparency over time.

MISTAKE #6: Rigid, Non-Adaptive Governance Structures

You built your governance model 10 years ago. The family was smaller. The portfolio was simpler. The world was different.

Now you've got multi-generational involvement, complex investments, regulatory shifts, and new technologies: but you're still running the same playbook.

Static governance models fail when reality evolves.

The Fix: Make Adaptation Part of the System

Adopt flexible governance structures that can evolve:

- Review your governance framework annually (minimum)

- Revisit your charter during family retreats or strategic offsites

- Create feedback loops that surface what's working and what's breaking

- Empower a governance committee to recommend updates without waiting for a crisis

The best family offices don't just respond to change. They anticipate it, prepare for it, and evolve ahead of it.

Your governance should be a living system, not a relic.

MISTAKE #7: Insufficient Documentation and Planning

Here's the nightmare scenario:

Your key decision-maker retires. Or gets sick. Or passes away. And suddenly nobody knows why certain investments were made, how relationships were structured, or where critical documents live.

Institutional knowledge walks out the door, and chaos walks in.

The Fix: Document Everything That Matters

Create and maintain:

- A governance charter (responsibilities, decision thresholds, meeting cadence)

- Succession plans for every critical role (family and staff)

- A knowledge repository of major decisions, rationale, and lessons learned

- Process documentation for recurring operations (investment review, manager selection, reporting)

Make documentation part of your operating rhythm, not a "someday project."

When the knowledge lives in people's heads, you're one accident away from disaster. When it lives in systems, you're building a legacy that lasts.

The Bottom Line: Governance Isn't Overhead: It's Your Operating System

Every mistake on this list has one thing in common: it's invisible until it costs you.

Unclear roles don't matter: until a deal stalls and no one knows who can approve it.

Poor communication doesn't matter: until a family member feels blindsided and trust shatters.

Weak conflict management doesn't matter: until litigation, family fractures, or a forced sale.

You don't get governance points for effort. You get results for structure.

The families that preserve wealth across generations aren't smarter, luckier, or more talented. They're just more intentional about how they operate.

They make the implicit explicit. They document what matters. They build systems that outlast individuals.

And they start before they have to.

Take the Next Step

If you've recognized even one of these mistakes in your family office, you're not alone. Most families are running on informal processes that worked when the wealth was smaller: but don't scale.

The question isn't whether you'll fix this. The question is when.

Want a second set of eyes on your governance structure? Let's pressure-test what you've built and identify the gaps before they become crises.

Book a 30-minute governance audit. No pitch, no obligation: just a clear-eyed look at where your structure is strong and where it's vulnerable.

Because the legacy you've built deserves governance that protects it.