Here's what nobody tells you when you're building a family office from scratch:

The families that preserve wealth across generations don't just have more money. They have better architecture.

I've watched brilliant entrepreneurs, people who built eight-figure businesses from nothing, stumble the moment they tried to transition into family office mode. Not because they weren't smart. Not because they didn't have resources.

They stumbled because governance, reporting, and manager selection aren't skills you learn building a company. They're entirely different disciplines. And if you get them wrong, you'll watch decades of wealth creation unravel in a single generation.

Let me show you how to get them right.

Why Most Family Offices Fail Before They Start

The mistake happens early. Someone says, "We need a family office," and the first move is hiring an investment manager or opening a bank account.

Wrong.

The first move is answering three questions:

- Why does this office exist? (Mission)

- Who does it serve, now and in 50 years? (Stakeholders)

- How will decisions get made when people disagree? (Governance)

Without clear answers, you're building on sand. You'll have beautiful investment portfolios and zero alignment. You'll have quarterly reports that nobody reads and family meetings that feel like hostage negotiations.

The families who win start with architecture, not activity.

Building Governance That Actually Works

Let me tell you about the Caldwell family (name changed). Third-generation wealth. $120M across real estate, operating businesses, and liquid investments. Sharp people. Good values.

When I met them, they'd been "running" their family office for four years. Except nothing was actually running. Board meetings lasted four hours and accomplished nothing. Simple decisions, like approving a $200K investment, took six months. Two siblings weren't speaking.

I asked one question: "Who has final say?"

Silence.

They had an operating agreement. They had advisors. They had Slack channels and monthly calls. What they didn't have was a decision-making framework anyone actually followed.

The Three-Part Governance Foundation

Here's what we built in 90 days:

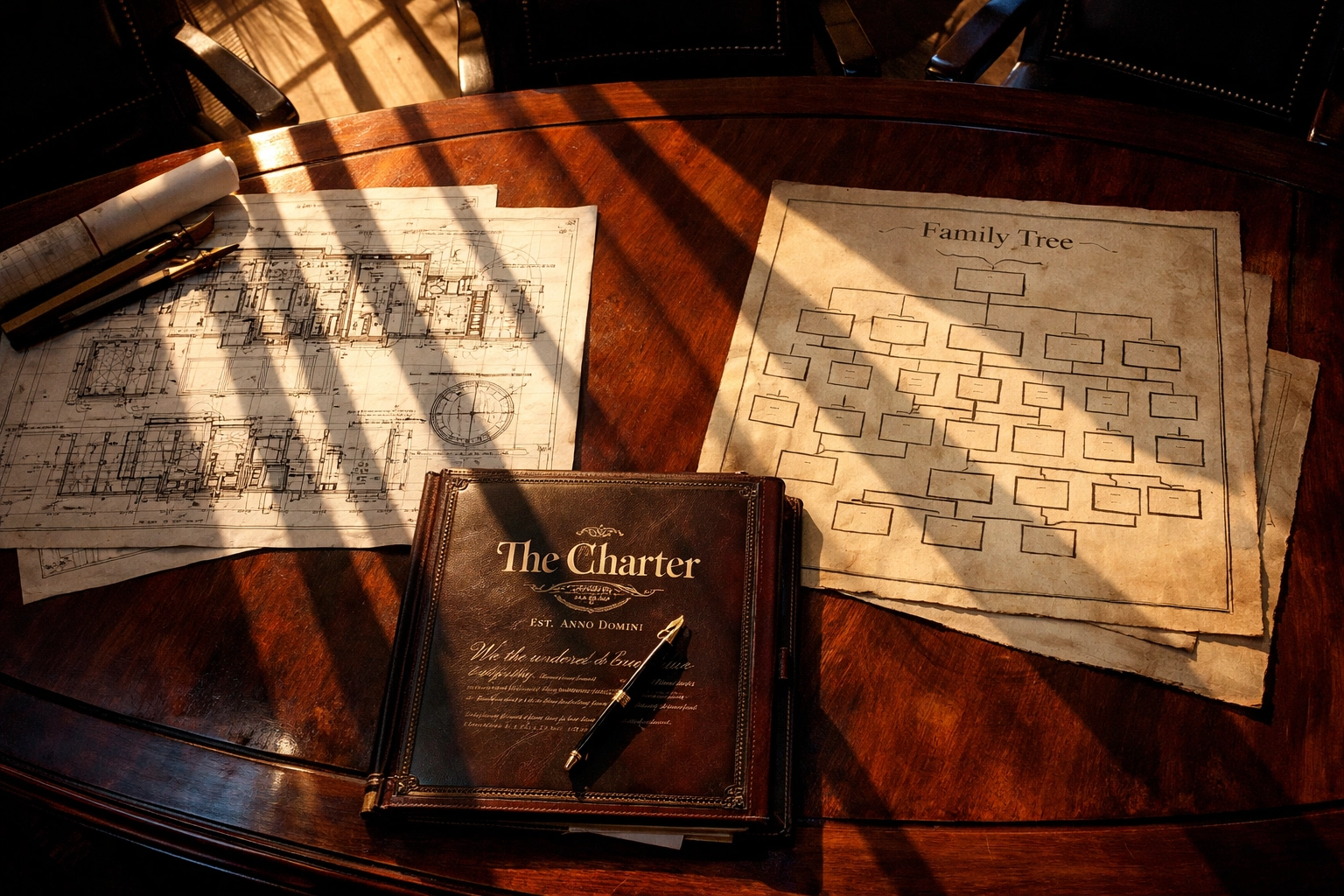

1. The Family Charter (One Page)

Not a legal document. Not a mission statement someone Googled. A plain-English charter that answered:

- What does this family office exist to protect and grow?

- What behaviors do we reward? What do we avoid?

- How do the next generation earn their seat at the table?

- What happens when someone wants out?

One page. Everyone signed it. It became the North Star.

2. The Decision Authority Matrix

We mapped every major decision type:

- Investments under $X → solo authority (defined)

- Investments $X–$Y → two-signature approval

- Investments over $Y → full board vote

- Strategic pivots → unanimous consent required

- Operating expenses → CFO discretion up to $Z

No more guessing. No more "I thought you were handling that." Just clarity.

3. The Conflict Resolution Path

When siblings disagree (and they will), what happens? We created a three-step escalation:

- Step 1: Direct conversation (24-hour rule)

- Step 2: Mediation with trusted advisor (72-hour rule)

- Step 3: Binding arbitration per operating agreement

The result? Meetings dropped to 90 minutes. Decisions moved in days, not months. The siblings started talking again.

Governance isn't bureaucracy. It's the invisible architecture that lets smart people move fast without blowing up.

Reporting That Builds Trust (Not Spreadsheets Nobody Opens)

You know what kills family offices? Information asymmetry.

One sibling thinks the portfolio is up 12%. Another thinks it's flat. The third hasn't opened a report in two years and just assumes everything's fine. Then a market correction hits, someone asks a question, and suddenly everyone realizes no one actually knows what's happening.

What Reporting Should Actually Do

Forget the 40-page quarterly decks with charts nobody understands. Real reporting does three things:

- Answers the question: "Are we okay?" (Portfolio health snapshot)

- Tracks what matters to THIS family (Custom metrics, not generic benchmarks)

- Flags risks before they become disasters (Concentration, liquidity, key-person dependencies)

The Caldwell Reporting Reboot

Here's what we implemented:

The One-Page Dashboard (Updated Monthly)

- Total net worth vs 12 months ago

- Liquidity ratio (cash + near-cash / annual spend)

- Top 5 positions (concentration check)

- Performance vs family-defined goals (not S&P 500)

- Red flags (anything requiring attention)

That's it. One page. Everyone gets it. Everyone reads it.

Quarterly Deep Dive (60 Minutes, Live)

- Investment performance breakdown

- Manager updates (what changed, what's next)

- Upcoming decisions (no surprises)

- Open Q&A

No presentations. No slides. Just conversation.

Annual Strategy Session (Half-Day Offsite)

- Review the charter (still accurate?)

- Update 3–5 year goals

- Assess manager relationships

- Plan liquidity events, succession moves, next-gen involvement

The magic isn't in the format. The magic is in creating transparency that removes paranoia.

When everyone sees the same numbers, hears the same updates, and knows the decision-making process is fair, trust compounds. When information is hoarded or opaque, families fracture.

Manager Selection: How To Avoid Hiring Your Biggest Liability

Here's the hard truth: Most family offices hire the wrong managers for the wrong reasons.

They hire the guy who managed their 401(k). Or their college roommate who "knows wealth management." Or the advisor who promises 15% returns with "low risk."

Then, three years later, they're stuck in underperforming relationships they don't know how to exit, paying 1.5% for mediocre results and wondering why their friends' family offices seem to run smoother.

The Manager Selection Framework That Works

Step 1: Define What You Actually Need

Before you interview anyone, answer:

- What expertise are we missing in-house?

- Are we hiring for investment management, tax strategy, estate planning, or operations?

- Do we want a single-family office (SFO) model, multi-family office (MFO), or external manager?

- What's our tolerance for complexity vs simplicity?

Don't hire a manager because "everyone has one." Hire because you've identified a specific gap.

Step 2: Vet For Alignment, Not Performance

Yes, track record matters. But here's what matters more:

- Do they understand family dynamics? (Can they navigate sibling disagreements without taking sides?)

- Are they transparent about fees, conflicts, and risks? (If they dodge questions, walk away.)

- Do they communicate in plain English? (If you can't understand their strategy in 60 seconds, it's not for you.)

- Will they challenge you when you're wrong? (Yes-men destroy wealth.)

The best managers tell you what you need to hear, not what you want to hear.

Step 3: Start Small, Test Accountability

Never hand over your entire portfolio to a new manager on day one.

Start with a pilot engagement: a defined scope, a six-month review, clear deliverables. If they perform, expand. If they don't, you've limited the damage.

And here's the key: review annually. Ask:

- Are they still serving our needs?

- Has the relationship improved or stagnated?

- Are we getting value for the fees we're paying?

- If we were starting today, would we hire them again?

If the answer to that last question is no, it's time to move on.

The Next-Generation Advantage

Here's where most families miss the biggest opportunity:

Involve the next generation NOW, not when it's too late.

The Caldwell family added a 27-year-old daughter to their quarterly advisory meetings. Not as a decision-maker (yet), but as an observer and learner. She asked questions. She shadowed the CFO. She sat in on manager reviews.

Two years later, she's the most financially literate person in the family. And when succession comes, she'll be ready.

Contrast that with families who "protect" the next generation from wealth complexity until the patriarch dies. Then they're thrown into the fire with zero preparation, and generational wealth evaporates in lawsuits, bad decisions, and family fractures.

Stewardship is taught, not inherited.

What To Do Next

If you're building a family office: or fixing one that's stuck: start here:

90-Day Family Office Foundation Sprint

Month 1: Governance

- Draft your one-page family charter

- Build your Decision Authority Matrix

- Define your conflict resolution path

Month 2: Reporting

- Create your one-page dashboard

- Schedule quarterly deep-dive format

- Set annual strategy session date

Month 3: Manager Audit

- List current advisors/managers

- Score each on alignment + performance

- Decide: keep, replace, or pilot new

You don't need a decade to get this right. You need clarity, decisiveness, and a willingness to build architecture before you build portfolios.

If you want a second set of eyes on your family office structure: or you're wondering whether you're ready to build one: let's talk.

I work with families navigating exactly this: the transition from entrepreneurial wealth to institutional stewardship. No sales pitch. Just a conversation about whether the foundation you're building will hold for the next 50 years.

Book 15 minutes here: https://tallpinze.com/contact

The families who preserve wealth across generations don't wing it. They build systems. They create clarity. They choose stewardship over hype.

You can be one of them.

: Kirk Jaffe

Managing Partner, Tall Pinze Advisory